Camera di commercio

ItalAfrica Centrale

La camera di commercio

Il progetto

Fondata nel 2004, ItalAfrica Centrale è stata riconosciuta Camera di Commercio Estera in Italia ai sensi della Legge 580/93 e D.M. 96/00 dal Ministero degli Esteri e dal Ministero del Commercio Internazionale ed è iscritta al n. 37 dell’Albo delle Camere di Commercio Italo-Estere o Estere in Italia.

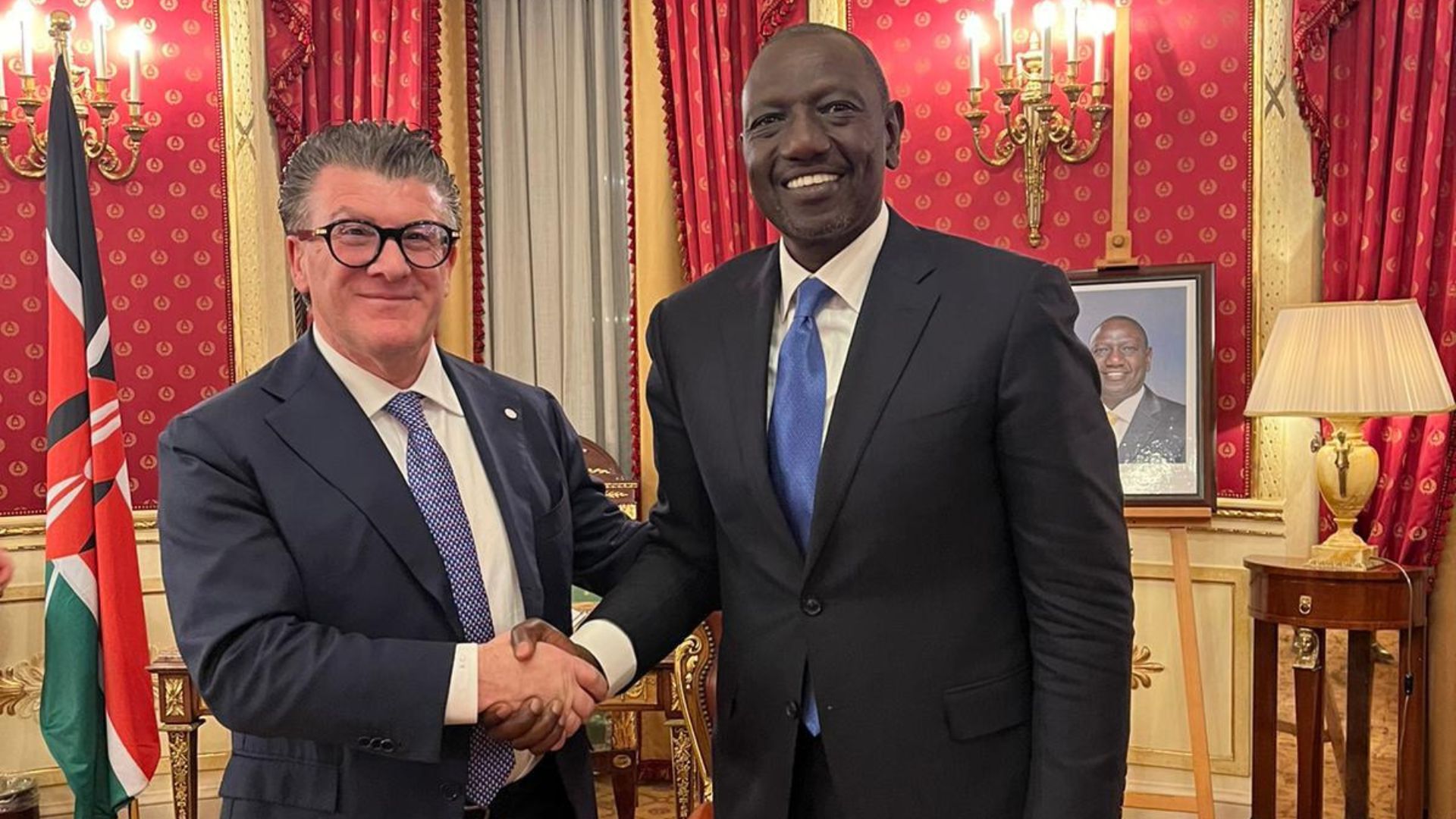

E’ presieduta dall’ing. Alfredo Carmine Cestari e si avvale della collaborazione e della consulenza di professionisti e di esponenti del mondo imprenditoriale e politico-culturale italiani ed africani.

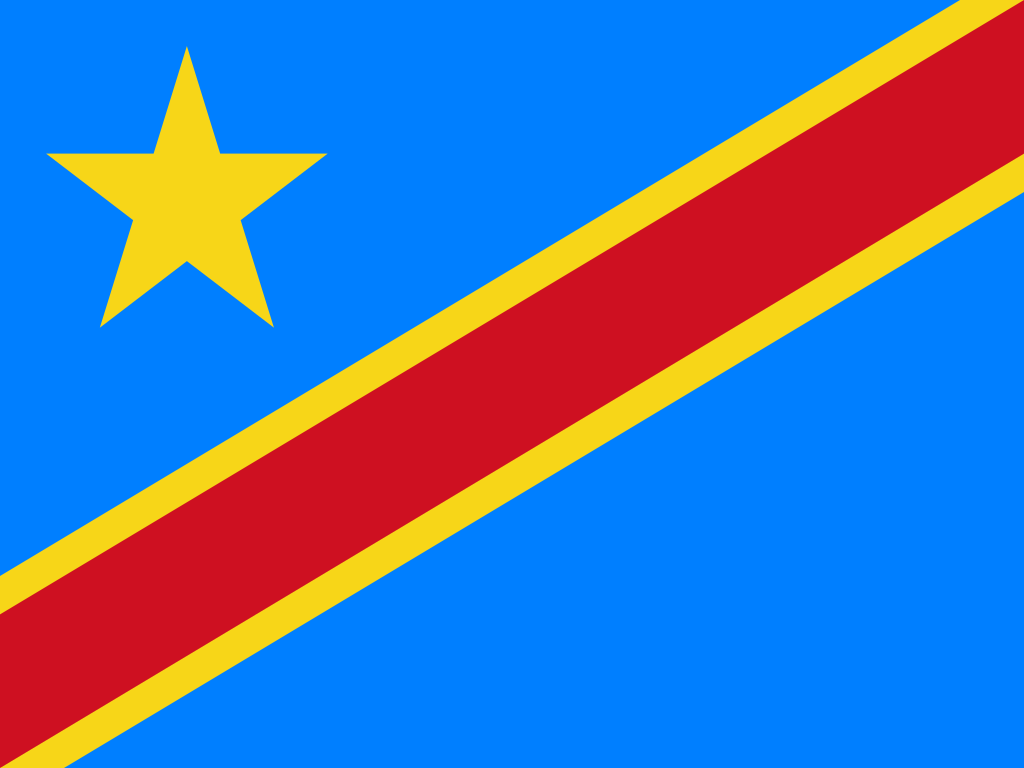

E’ presente con proprie sedi a Milano, Napoli, Roma, Salerno, Potenza, Bruxelles, Kinshasa nella Repubblica Democratica del Congo, Pointe – Noire nella Repubblica del Congo, Kigali nella Repubblica del Rwanda.

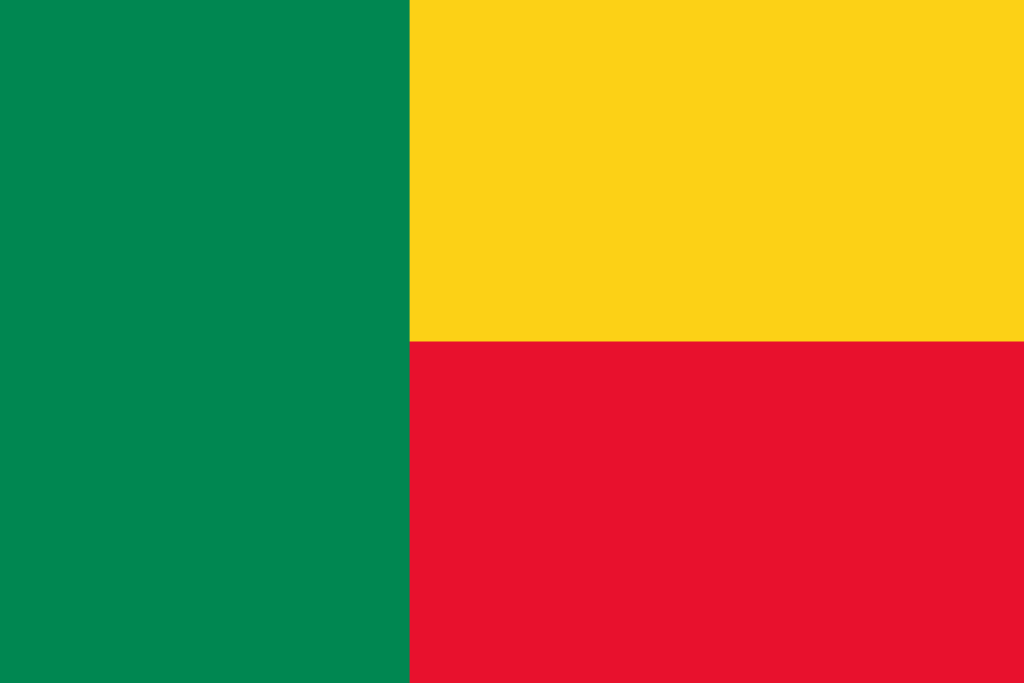

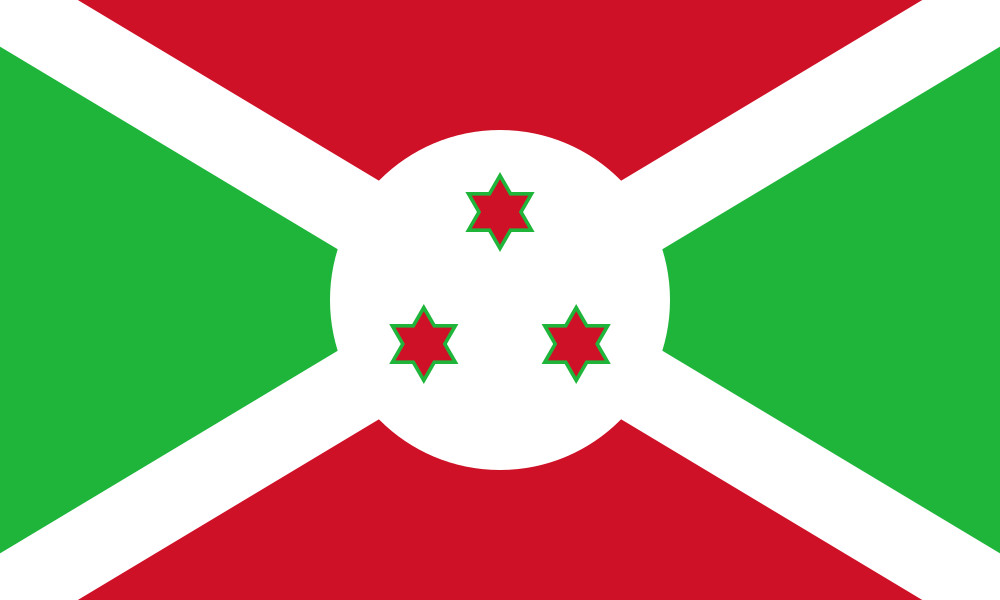

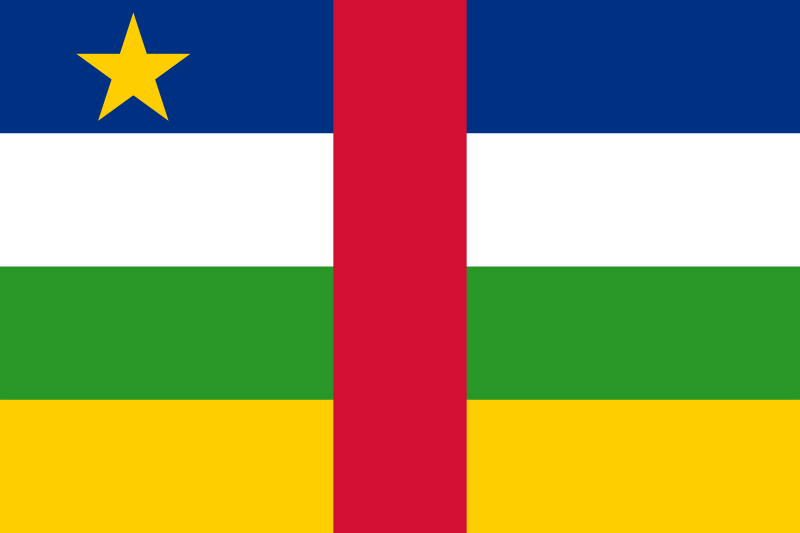

Rappresenta l’unica struttura italiana capace di coinvolgere nelle sue attività i 19 Paesi dell’Africa Continentale: Angola, Benin, Burundi, Camerun, Repubblica Centrafricana, Repubblica del Congo, Repubblica Democratica del Congo, Gabon, Kenya, Malawi, Mozambico, Namibia, Ruanda, São Tomé e Principe, Sudan, Tanzania, Uganda, Zambia, Zimbabwe. Risultano in via di adesione le sottoscrizioni di protocolli d’intesa con altri Paesi.

ItalAfrica Centrale

I servizi della Camera di Commercio

La Camera di Commercio provvede tutti i servizi necessari per iniziare ed investire in attività commerciali, industriali ed economiche nel continente africano.

Business contact

Conosci la squadra

I fondatori e collaboratori

Le attività della Camera di Commercio

Ultimi progetti e bandi

La Camera di Commercio ItalAfrica Centrale è sempre attiva nella creazione e realizzazione di progetti nell’Africa Centrale e Subsahariana.

01

Fiere

Informazioni paese aggiornate e su eventi fieristici dei 19 paesi di competenza e assistenza nel reperimento di fonti finanziarie in Italia e nei paesi dell’Africa centrale e Subsahariana.

02

Seminari tecnici

Seminari tecnici di formazione ed informazione per gli operatori economici italiani, fornitura di aggiornamenti sulle normative in materia di investimenti, privatizzazioni, documentazioni, licenze.

03

Gemellaggi

Realizzazione di gemellaggi tra città italiane e dell’Africa Subsahariana quale strumento per la costruzione e la promozione di rapporti di scambio, collaborazione, conoscenza, solidarietà, e del dialogo interculturale.

Area utenti

Per partecipare alle attività della Camera di Commercio e ricevere le ultime informazioni sui progetti

Eventi e News

Piano Mattei: resilienza e investimenti Italiani in Africa

Il “Piano Mattei” sta rivoluzionando gli investimenti italiani in Africa grazie all’Iniziativa Italia-Africa. Nell’articolo il video del convegno alla Camera.

Conferenza Italia-Africa: un’opportunità di cooperazione

Scoprite come la cooperazione Italia-Africa sta aprendo nuove opportunità di crescita economica e sostenibilità in un mondo in evoluzione.